HAMAK GOLD LIMITED – Investor Presentation

View our investor presentation hosted by InvestorMeetCompany

S10 Ep36. The Sunday Roast:Midweek Takeaway, with Nick Thurlow

In this episode of The Midweek Takeaway, Kevin Hornsby is joined by Nick Thurlow, Executive Chairman of Hamak Gold (LSE: HAMA), to discuss the appointment of Nicola Horlick as Non-Executive Director. With over 35 years of experience in institutional fund management and fintech innovation, Nicola brings significant governance and investment expertise to the board. The […]

Zak’s Traders Cafe, with Nick Thurlow

Zak Mir talks to Nick Thurlow, Executive Chairman, Hamak Gold in the wake of the announcement of the acquisition of 20 Bitcoin as part of its broader capital allocation and treasury management strategy. This move marks the Company’s first foray into digital asset investment and reflects a proactive approach to value creation and balance sheet […]

S10 Ep27. The Sunday Roast:Midweek Takeaway, with Nick Thurlow

In this episode of The Midweek Takeaway, we’re joined by Nick Thurlow, the newly appointed Chairman of Hamak Gold, to discuss the company’s bold new direction. Hamak is blending traditional gold exploration in Liberia, most notably at the high potential Nimba project, with a pioneering Bitcoin treasury strategy, becoming one of the first UK-listed explorers […]

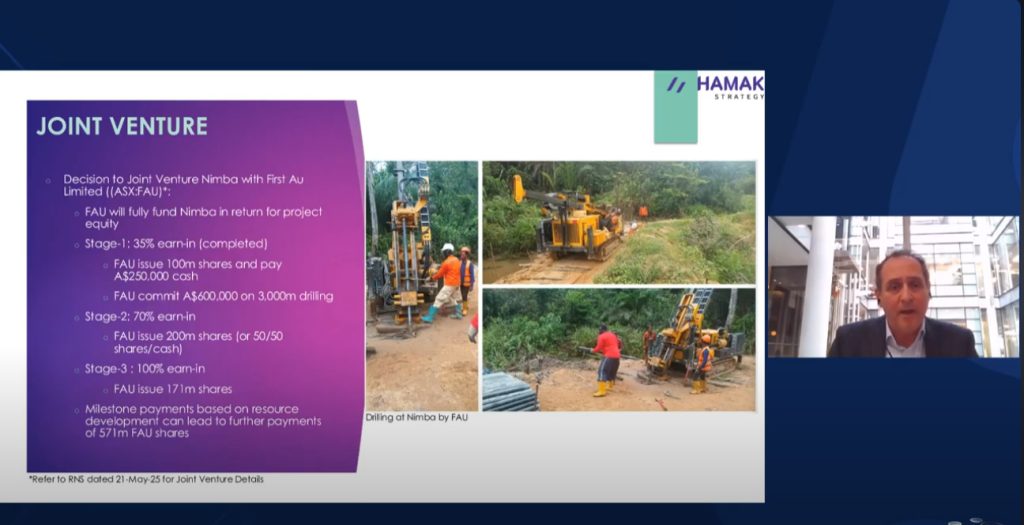

Zak Mir talks to Karl Smithson

Zak Mir talks to Karl Smithson, Executive Director, Hamak Gold, as the company announces that it has entered into a partnership with ASX-listed First Au Limited (ASX: FAU) in relation to the Nimba project in Liberia. Inter-alia, under the Agreement, FAU will be responsible for funding further ongoing exploration work and drilling at Nimba. As […]