Investment case

Dual Exposure. One Listed Vehicle. Gold + Bitcoin Strategy.

In 2025, Hamak launched a Bitcoin Treasury Management (BTM) strategy, becoming one of the first UK Main Market-listed companies to integrate Bitcoin into its treasury operations.

Dual-Track Growth Model

Hamak Gold Limited (LSE: HAMA) offers investors a unique opportunity to gain exposure to two globally recognised stores of value:

Bitcoin Treasury Strategy – A First-Mover Advantage

In 2025, Hamak launched a professionally governed Bitcoin Treasury Management (BTM) Policy, allocating part of its treasury into Bitcoin as a long-term, macro-resilient reserve asset.

- One of the first UK Main Market-listed companies to integrate Bitcoin

- Offers institutional and professional investors exposure to digital assets within a listed structure

- Enhances long-term capital preservation alongside gold exploration

- Backed by strategic advisors and experienced executives in digital finance, regulation, and investment

High-Grade Gold Discovery in Liberia

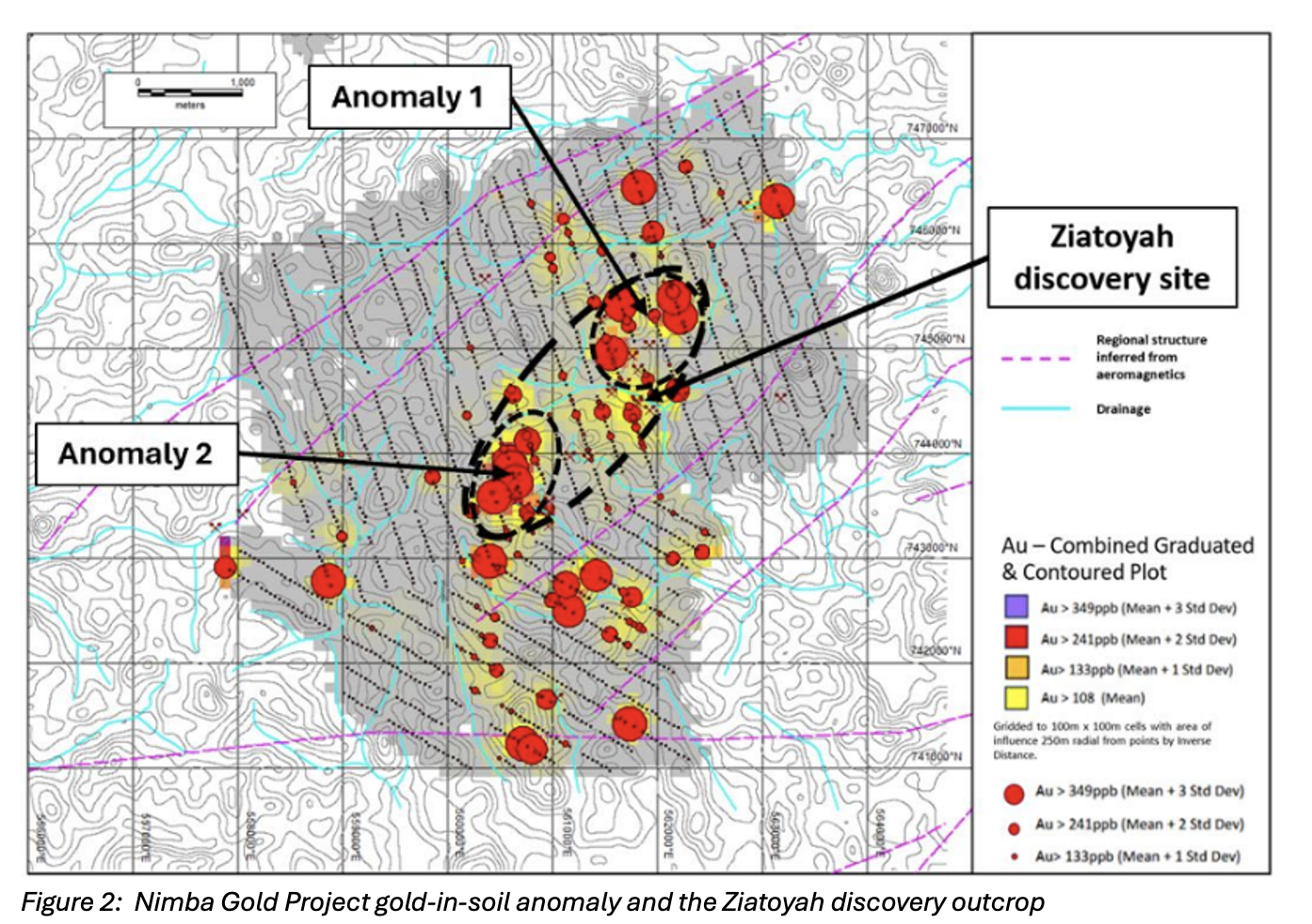

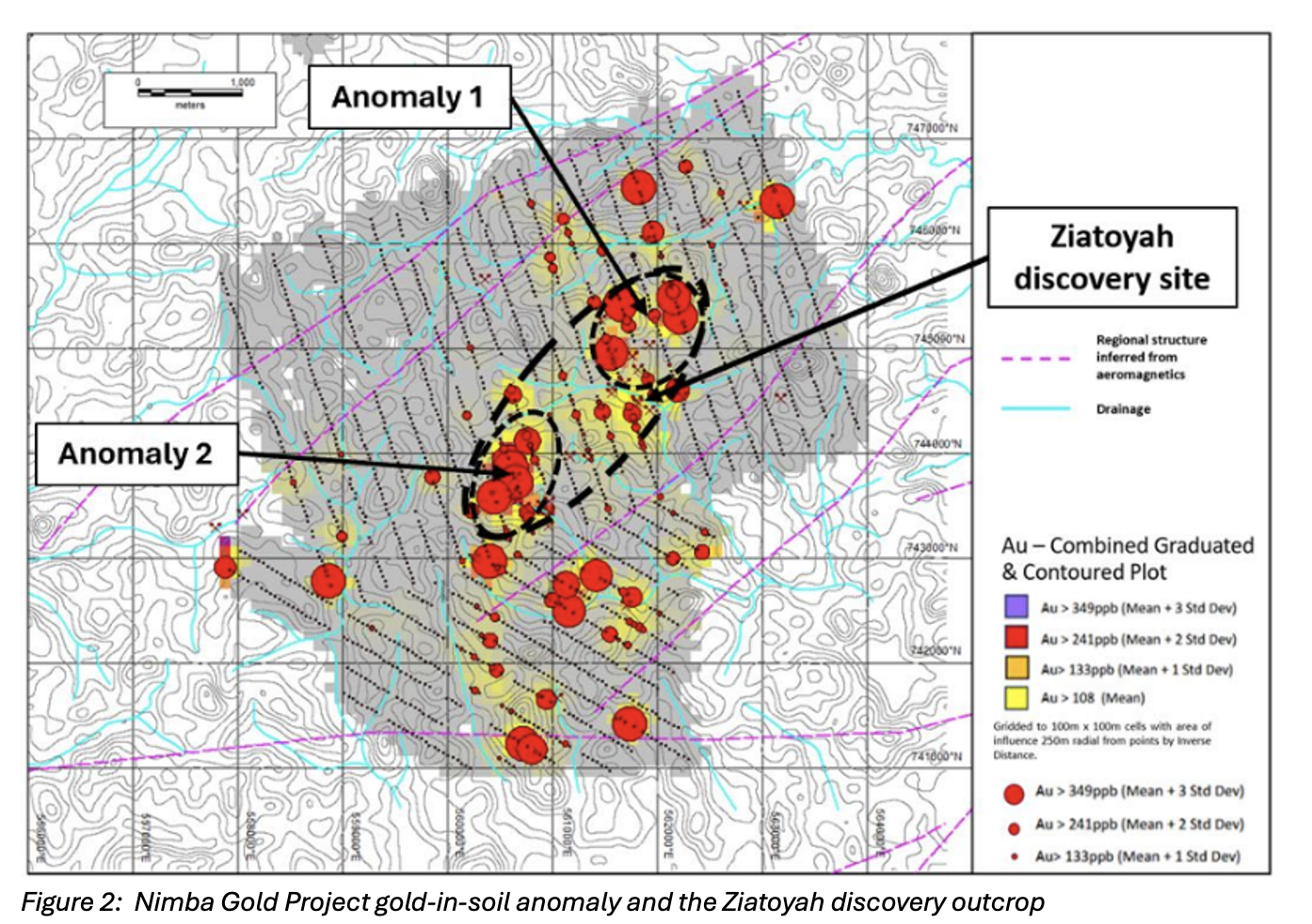

Through its wholly owned Liberian subsidiary, 79 Resources Inc., Hamak holds the Nimba Exploration Licence (MEL 7012725) covering 831 km².

- Located adjacent to the 5Moz Ity Gold Mine (Endeavour Mining

- Strong drill intercepts including 20m at 7g/t Au

- Trenching results of 0.63g/t over 55m and 1g/t over 11m

- Large-scale 5.7km x 1km gold-in-soil anomaly

Leadership, Governance & Advisory Strength

Our Board and Management combine decades of experience in West African gold exploration, institutional finance, and digital asset strategy.

- Led by a restructured board with deep expertise in exploration, finance, compliance, and fintech

- Includes former executives from Standard Chartered, HSBC, and investment management firms

- Strategic Advisors include: Arthur Laffer – globally respected economist and advocate for decentralised finance

Near-Term Catalysts &

News Flow

We push regular updates to our investors.

- Active drilling at Nimba to deliver regular technical results

- Bitcoin treasury updates via transparent market communications

- Ongoing evaluation of additional high-potential gold projects

- Strategic news and developments planned throughout 2026