Unlocking Gold Value in West Africa with Dual Investment Strategies

Hamak is a Main Market-listed company focused on delivering shareholder value through the discovery and development of high-grade gold assets in West Africa. Alongside this core strategy, we adopt a Bitcoin Treasury strategy in order to provide diversified exposure to digital macro-assets.

Unlocking Gold Value in West Africa with Dual Investment Strategies

Hamak is a Main Market-listed company focused on delivering shareholder value through the discovery and development of high-grade gold assets in West Africa. Alongside this core strategy, we adopt a Bitcoin Treasury strategy in order to provide diversified exposure to digital macro-assets.

West African Gold Discovery

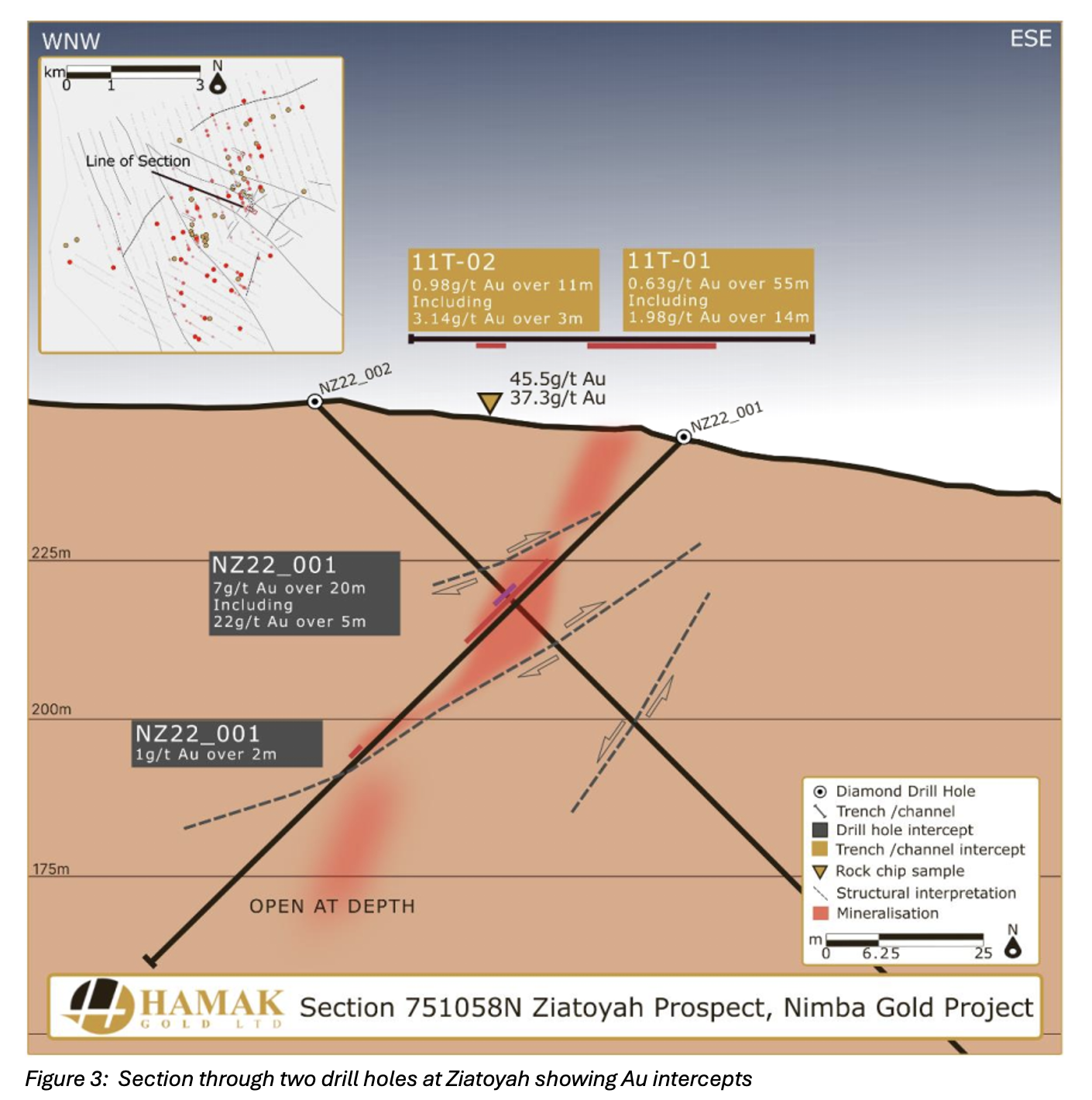

Focused on Liberia’s highly prospective Nimba Project with standout drill results and significant growth potential.

Dual Value Strategy

Combining gold exploration with Bitcoin Treasury exposure to offer diversification across two different asset classes

Growth Pipeline

Active drilling in 2025 plus evaluation of new West African opportunities to expand the portfolio.

Company achievements timeline

We are committed to being a business that balances purpose with profit that create value for all our stakeholders.

Hamak Gold IPO

Raises £955,000 to advance Liberia gold exploration

March 2022

High-Grade gold discovery

In Nimba permit, Liberia

June 2022

First drilling at Nimba

Intersects significant high grade mineralization of 20m @ 7g/t Au near surface

December 2022

Additional funding

Funding of £300,000 to advance Nimba exploration

December 2022

Further positive exploration

Results shown from geophysical survey

May 2023

Additional funding

Funding of £350,000 and new drilling programme at Nimba

July 2023

Additional funding

Funding of £200,000 to advance Nimba exploration

April 2024

Joint Venture

Enter Terms Sheet with First Au Limited for Joint Venture over Nimba

January 2025

Board changes & Funding

Funding of £2.5 million, Board Changes and Announcement of new strategy combining gold exploration with Bitcoin treasury management.

July 2025

New appointment

Appointment of world renowned economist Dr. Arthur Laffer to advisory board

July 2025

New appointment

Appointment of seasoned institutional city banker Nicola Horlick as NED

August 2025

Shares allocation

Receipt of A$250,000 and 100 million shares in First Au Limited as Nimba JV earn-in

August 2025

New Appointment

Appointment of leading advisor on digital assets Brittany Kaiser to Advisory Board

September 2025

The company

HAMAK Strategy

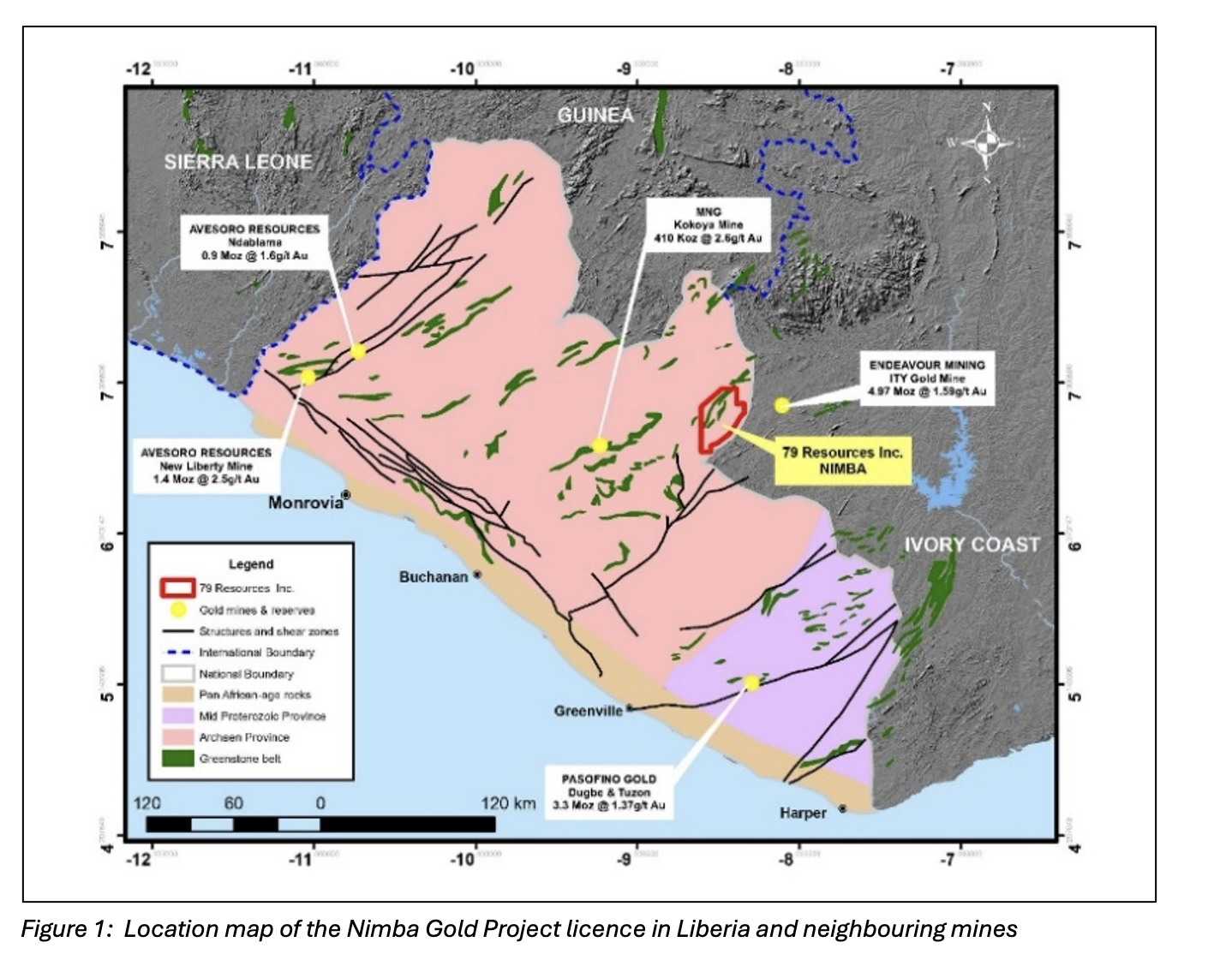

We are a mining exploration and development company operating in Liberia, with a gold project in Liberia under a Mineral Exploration Licence (MELs) that covers an area of 827.22 km2. Liberia is considered highly prospective for gold, and is a geologically similar jurisdiction to the neighbouring gold producing countries such as Guinea, Côte d’Ivoire, Mali, Senegal, Burkino Faso and Ghana.

Through Hamak Gold’s Liberian registered subsidiary company 79 Resources Inc., a new exploration licence was applied for in late 2024 covering a similar area to the former Nimba licence and granted on 23 January 2025, This new licence has an initial tenure of 3 years, which can be extended (subject to statutory compliance) for a further 2 years of exploration time.

Bitcoin Treasury Management (BTM)

In 2025, Hamak launched a Bitcoin Treasury Management (BTM) strategy, becoming one of the first UK Main Market-listed companies to integrate Bitcoin into its treasury operations.

This strategy enables investors to gain regulated exposure to Bitcoin alongside gold—two globally recognised stores of value.